A common Western misconception

“Made in Hong Kong” was imprinted on many of the toys in my boyhood days (way back in the seventies). Then this label was synonymous with “cheap”, “plastic”, “throw away after light use”. At that time China meant little more to me than the occasional meal at a restaurant, the timeless wisdom of a nation as portrayed in the sayings of Confucius, or the iron-fisted communism and class struggle headed by Chairman Mao. Quite frankly, today China is much more than world’s manufacturing workbench. It’s well on its way in advancing to a major R&D force whose impact is beginning to be felt by high-tech consumers around the world. Are the days of “Designed in California - Assembled in China” numbered?China: think big, think volume

When a topic touches something as vast and far away as China, it’s tough staying grounded and getting the facts right. Clearly China not only has the brains, capability and drive to impact technology worldwide. More than that it has an immense end-user base at home that allows scaling volume production into realms unthinkable for many of us in the West. Case in point: China Mobile boasts some 750 million subscribers. That’s on par with the total population of Europe! Imagine, one single wireless operator with this sheer number of customers at the controls of mobile voice, messaging, apps, handsets and other desirable services.Reaching out and moving in

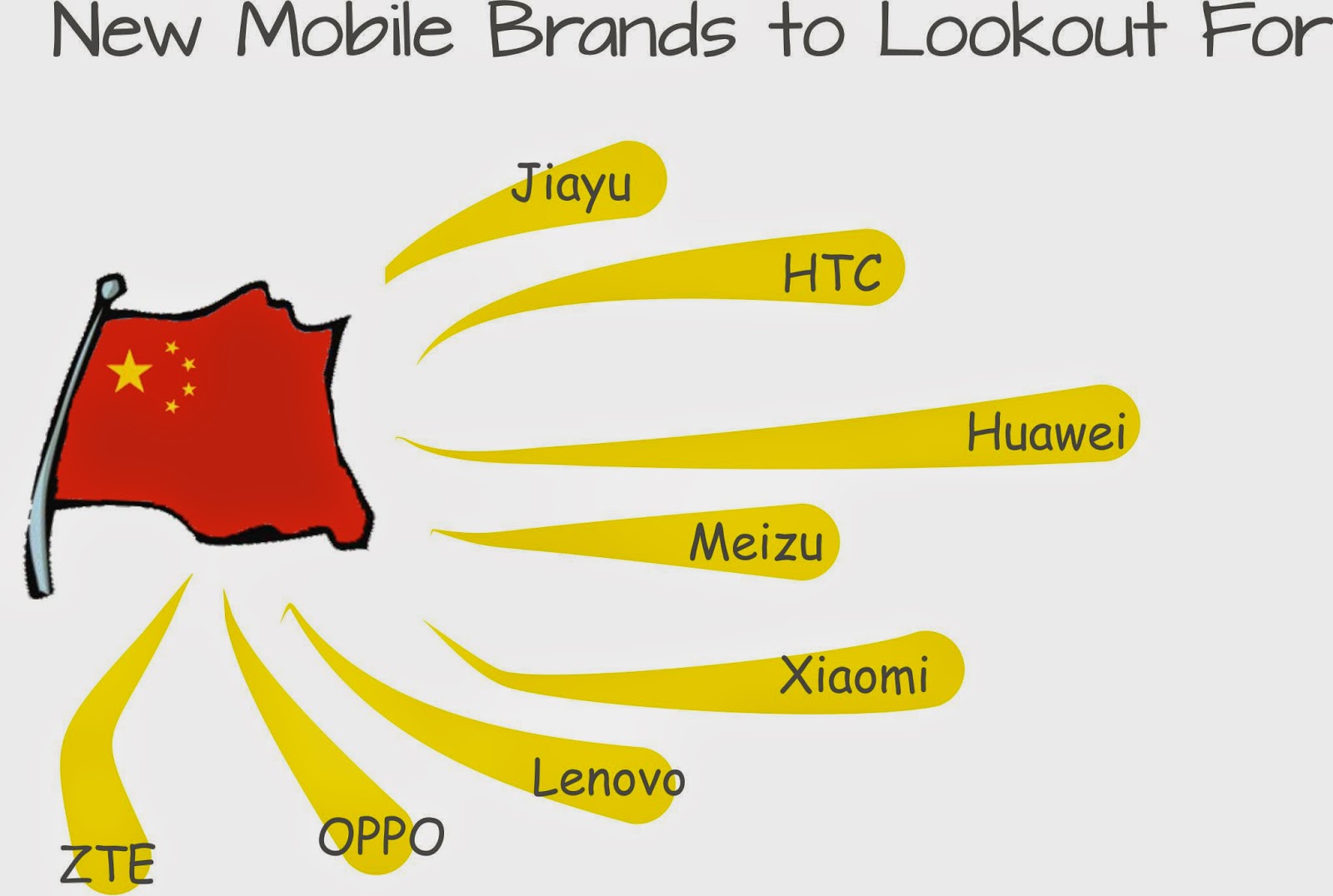

On the infrastructure side Chinese companies like Huawei and ZTE have already made inroads in foreign markets. I remember their sleek offices quietly opening in Dusseldorf on the river Rhine several years ago. Price disruptions in telecoms infrastructure followed and ever since Alcatel-Lucent, Ericsson and NSN (Nokia Solutions & Networks, formerly known as Nokia-Siemens Networks) have been feeling the bite at their established clientele. Yet it’s not all threat. Flip the coin and China’s colossal market offers tremendous trade opportunities for foreign companies.Telecoms market research on China

In wi360’s research and event directory you will find many studies from various sources that provide a detailed view of China’s mobile and wireless landscape. Here are a few sample results when entering “China” in the Search field for Reports at wi360 .- China Telecommunications Report from Business Monitor International provides an overview of the Chinese telecoms market. In addition it profiles 19 MVNOs (mobile virtual network operators) in the country.

- China’s top five vendors account for 20% of the world’s smartphone shipments from Canalys ranks smartphone vendor shipments and growth in China’s domestic and foreign markets

- The Mobile Industry Alliance’s (MEA) Certimo benchmark measures user experience ratings for popular Android smartphones sold in China from manufacturers such as HTC, Huawei, Lenovo, LG, Meizu, OPPO, Samsung, Sony, Vivo, Xiaomi and ZTE, and these have been published by Tencent, China’s largest Internet portal. Results can also be found on MEA’s website.

- Consumer Demand Analysis of Smart Wearable Devices in China is a survey from MIC - Market Intelligence & Consulting Institute in which Chinese consumer purchasing behaviour with respect to wearables is profiled

- TD-LTE Market Developments and Forecast, 2014–2016 from Digitimes details mobile networks based on China’s homegrown TD-LTE standard and their outlook in 17 further countries where they have been deployed

- Strategy Analytics’ report titled China Mobile’s One Man Show to End reveals the strategies of China’s three operators regarding LTE FDD (note: not TD LTE) infrastructure in the country

- Global and China EMS and ODM Industry Report, 2013–2014 from ResearchInChina takes stock of manufacturing services for consumer electronics in China, Taiwan and other countries around the world

Understanding China and its wireless markets as well as the companies, services and products that comprise it mobile ecosystem is an important step in spotting and tapping potential opportunities and participating in the country’s unquestionable growth in trade. Western manufacturers may even be at an advantage in being able to produce high-quality kit at much lower production volumes that allow product customisation and variation. “Designed in California - Assembled in California” could potentially be a prized imprint from the perspective of future Chinese consumers.