Part II of “Video Rules - Codecs Engage” reviewed the next-generation video codec scenario and the potential, forward-looking success of its contestants and their solutions, namely the industry alliances MPEG LA, HEVC Advance and Alliance for Open Media (Google, Cisco, Amazon, Netflix, Intel, Microsoft and Mozilla). Here in Part III video market segmentation takes center stage, affording a clearer picture of how the ecosystem is changing and what sectors offer future rewards

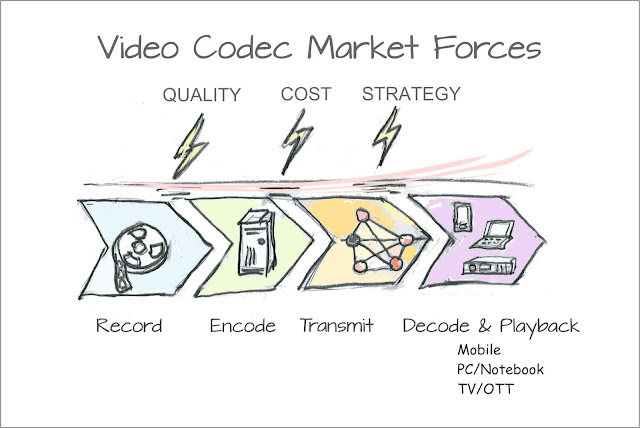

Next-gen video codecs such as HEVC and VP9 further cut the bandwidth required for transmission and storage by half without perceivable loss of video quality which is why using them makes good technical and business sense. Employing them means that recorded footage needs to be encoded, stored, transmitted, and decoded on the device at the receiving end.

The many players in this video transmission ecosystem pay careful attention to the number of video consumers they will ultimately reach at the receiving end in their choice of a codec . The more, the better. The codec that best manages to permeate the ecosystem is most likely to be a winner.

|

The mobile video explosion

Data source: Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2015–2020 |

|

Segmenting the end-user market is helpful before placing your bets. Inspecting each of the following three market silos delivers useful data for any prediction:

- Appliance segment: TVs, set-top boxes (STB) for terrestial, cable and satellite broadcasts

- Desktop segment: PCs, notebooks

- Mobile segment: smartphones, tablets, media players

Pegging each segment’s size is no easy task but let’s give it a try using data available from reliable sources combined with a good dose of common sense. We’ll use the metric “bytes” to gauge size as it’s easiest for comparative purposes.

For 1 (appliances) I’ll venture to make a broad simplification to arrive at some ballpark figure: assuming that under half of the world's population (let's say 3 million TV consumers) watch one hour of TV a day on average (some watch several hours, some don’t/won't/can’t at all, whilst a few may come close to 24/7 behaviour) and assuming all video content is H.264 coded at 1280 x 720 resolution running 25 frames per second:

60 minutes/day x 150 Mbytes/minute x 3 billion people = 27 EB per day

1 exabyte (EB) is 1000 6 bytes or 1 000 000 000 000 000 000 000 bytes

Of course not all TV that is broadcast is encoded in H.264 as assumed in the above calculation. Mostly it’s HDTV that uses H.264 (see

Wikipedia’s list of video services using H.264). For the sake of arriving at meaningful comparative data, I've deliberately used this simplification.

For the 2 (desktop) using data provided by

Cisco in their February 2015

Visual Networking Index Forecast, online video that is downloaded or streamed for viewing on a PC screen is forecasted to account for approximately 23 EB of monthly Internet traffic in 2015, leading to roughly 0.766 EB of PC/notebook video per day.

For 3 (mobile) using data provided by

Cisco in their February 2016

VNI Global Mobile Data Traffic Forecast, video accounted for 55 % of 3.7 EB total monthly

mobile data traffic in 2015. For 3 that approximates to 0.068 EB per day for all mobile video traffic.

Here’s the corresponding table for daily video traffic in 2015:

| Appliances |

Desktop |

Mobile |

| 27 EB |

0.766 EB |

0.068 EB |

| 100 % |

2.8 % |

0.3 % |

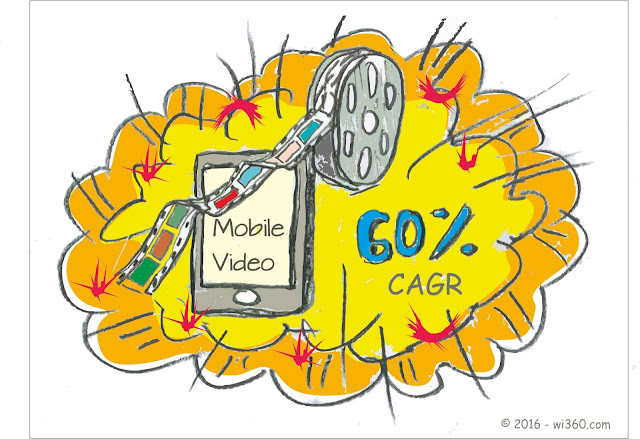

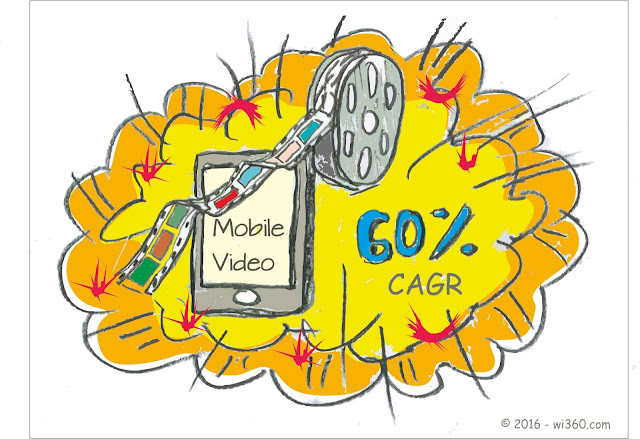

It’s apparent that both desktop and mobile video are still dwarfed by video broadcast to appliances, but keep in mind, markets for video are in a disruptive mode, as the younger generation spend more time watching short, on-demand video clips delivered to their smartphones instead of viewing prime-time TV shows. Cisco’s data validates this behaviour in that

video consumed on mobile devices is set for compound average growth rates of almost

60 % per year for the period 2015 - 2020, the fastest growth rate of all. In summary, mobile video will be gobbling up market share of broadcast and PC video at a fast pace.

Let’s look at these market segments regarding the codecs used.

Appliances: TVs, Set-Top Boxes (STB) and Other Nifty Devices

In terms of size and revenue, this is by far the most relevant of all three. You could call it the

professional video segment that is in transition from broadcasting video content over-the-air (OTA) or pay-TV video-on-demand (VoD) to the newer variant of streaming professionally recorded media over-the-top (OTT) of wired or wireless data connections. Its hinges on interoperability, legacy equipment and fallback modes. H.264 is the established and well understood standard supported by most appliances. But the industry is in flux and looking to better codecs such as HEVC or VP9 for achieving lower transmission bit rates or supporting ultra-high resolution (UHD) devices.

In this segment HEVC (H.265), the follow-up standard to AVC (H.264), is used to compress some of the best and most popular studio-grade 4K streaming media currently, supported by most 4K-UHD-enabled appliances and used for professionally recorded 4K-content streamed by providers such as Netflix and Amazon Prime. Some video experts go so far as to say that HEVC/H.265 has already won the battle against Google’s VP9 simply based on the fact that AVC/H.264 has worked well for all industry participants in the past despite the licensing costs involved.

In other words, why risk turning your back on a proven business model?

Next to the cost issue (remember Google’s VPx compression is free), companies involved with creating and selling media products and services are willing to pay licensing fees

(i) if licensing is a simple procedure that also idemnifies them from possible future “submarine patent” claims as outlined in

a previous blog

(ii) if the fees are reasonable in relation to generated revenues through products/services

H.264 fulfilled these requirements to a large extent: acceptable licensing terms and one company,

MPEG LA, handling the complete licensing process.

H.265 appears to have muddied the pond in both respects: now it’s two parties - MPEG LA and HEVC Advance - with unclear patent lists, and hair-raising licensing costs regarding the latter’s terms that also add never-seen-before royalties on HEVC-encoded content itself.

Good reasons to consider alternatives, right?

One alternative for professional media is to continue using H.264 as long a possible. This is even attractive in terms of compression rates, as codec standards don’t specify the method used to encode and decode their compressed streams, only the syntax used. As such there are many initiatives to extend H.264’s life cycle with better compression algorithms “inside”.

The other is to wait until the competitive, open-source codec from the consortium called the

Alliance for Open Media (Google, Amazon, Cisco, Microsoft, Mozilla, Netflix and Intel) becomes available some time in early 2017.

Desktop and Mobile Video Market Segments

In constrast to the appliances segment,

desktop and

mobile additionally support

user-generated content. As mentioned previously, this segment is exploding in size as amateurs create their own videos that mostly run under a few minutes, are uploaded to public servers such as Google’s YouTube and consumed online by millions.

Desktop and mobile video users access compressed video on their devices either

- through a native application like a “media player” for a PC or an “app” on a smartphone.

- through their browser (or a 3rd-party plug-in for it)

Two “native application” examples are

VideoLAN’s VLC player for the Windows or OSX operating systems, or YouTube’s app for smartphones running either iOS (Apple) or Android (Google) operating systems. Licensing costs for the codec are picked up by the creator of the app in most cases.

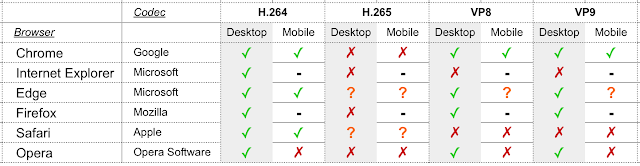

For codecs used within the browser, the browser vendor frequently pays the licensing costs. In some cases the browser relies on decoding support by the operating system (OS), thereby relegating the licensing cost to the OS vendor, or even one level deeper, to the hardware decoder - a functional block within a chip - found in the device itself which improves performance and mitigates battery drain.

If you compare the browser and operating system manufacturers with the members of the Alliance for Open Media, it isn’t hard to guess which next-gen codec is likely to take on the lead role in this particular segment.

In addition Google’s current VP9 codec is already being used for 4K video streaming on YouTube. Moreover, it’s also supported by a wide range of major TV makers like LG, Sony, Samsung, Panasonic, Toshiba, Philips and even GPU/processor makers like Intel and Nvidia. Google is continuing to bet on the principles of open, community-developed technologies and their speed of implementation to drive adoption in the hope of out-engineering the competition at some future point.

The writing seems to be on the wall on whom to use for future mobile and desktop markets. It’s once-in-a-lifetime chance to displace the H.26x incumbent a la longue in the professional segment too. Yet there might be unexpected twists down the road if essential patent holders block licensing initiatives or unexpectedly decide to change sides .

Stay in touch with mobile video market updates using

wi360’s Event Calendar where you’ll find current conferences, expos, webinars and workshops that track streaming video listed under the category

Multimedia.